A New Era of Investing

The 1960s gave birth to the Go-Go Years on Wall Street, a significant cultural shift that coincided with the early success of William J. O’Neil, an outstanding young trader with his own signature style of stock analysis. In a 1969 New York Times review of The Money Managers, a book in which Mr. O’Neil was profiled, he was recognized as one of a “new breed of men,” whose method of preserving client’s capital was not to invest in an ultra-conservative portfolio of blue chip stocks, but “to double it—in a hurry.”

The Go-Go years allowed Mr. O’Neil to do more than make a lot of money. He took his profits and built the foundation of a company that has endured for 50 years. His passion for the market became a passion for stock investing education. In his view, anyone could experience the success in the market that changed his own life.

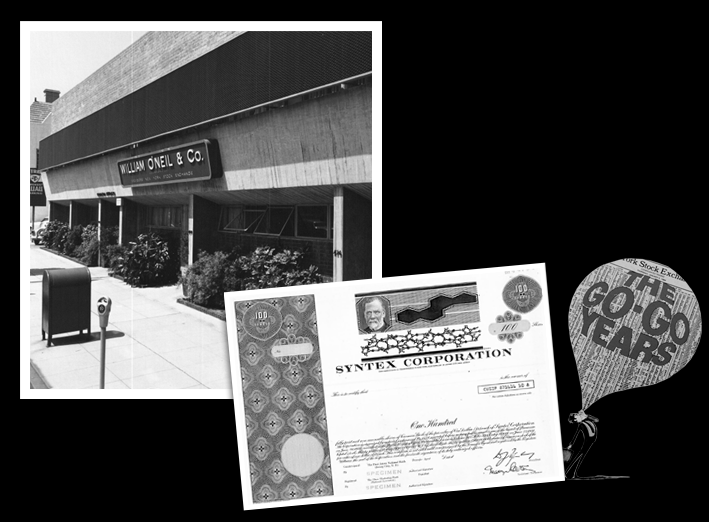

William J. O’Neil founded William O’Neil + Company in 1963, funded by his exceptionally outperforming trades in stocks, including Korvette, Certain Teed, and Syntex. In January 1964, at the age of 30, O’Neil bought a seat on the New York Stock Exchange, the youngest person at the time to do so. While many investors were relying on P/E ratio as a key stock screening metric, O’Neil was studying historical models and developing a proprietary trading methodology using quantitative and qualitative analysis—the method we use today.

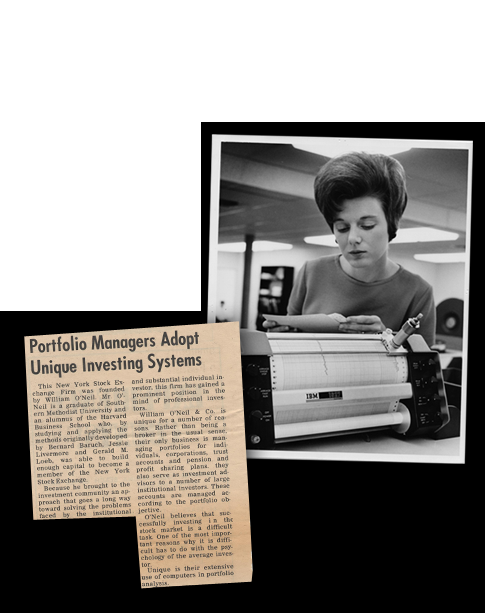

Innovative Technology

To speed that analysis, O’Neil looked to innovative technology, making his firm one of the first in the financial industry to embrace the computer for stock screening and chart plotting. His IBM 360-40-128K computer, programmed to filter stocks for fundamental and technical data, occupied a quarter-acre of office space, with an accompanying CalComp digital plotter translating the data into stock charts. Between 1964 and 1968, William O’Neil + Company invested more than $2 million in research and development—a level of commitment to technology unheard of at the time.

“We don’t believe in arguing with

the reality of the marketplace.”

�William J. O’Neil, Institutional Investor, April 1968

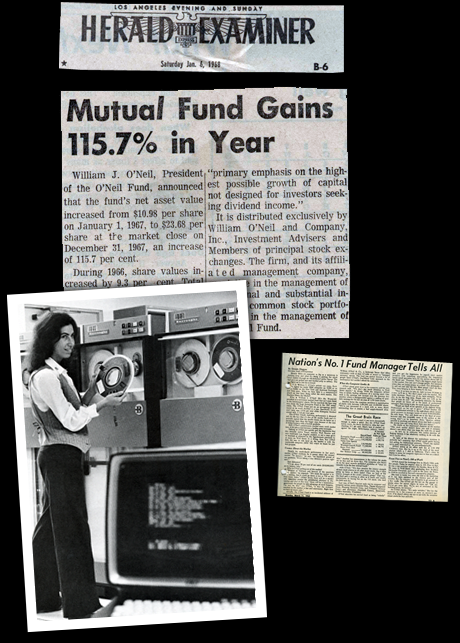

His disciplined approach to trading and use of technology continued to support O’Neil’s edge in trading performance. In December 1965, he formed the O’Neil Fund. Two years later, the fund took the financial world by surprise by becoming the top-performing fund in the country, appreciating 115.7%, more than double the national average of 51.1%. With the New York Stock Exchange 3,000 miles away, this outperformance put William O’Neil + Company and Los Angeles on the map of the financial world.