Navigating a Volatile Market

The 1980s marked a decade of excess: big hair, bright colors, and bold attire. Everything was growing, including credit card limits, expense accounts, and megamerger-formed corporations—even our meals were being “supersized.” Technological advances took a quantum leap. With the introduction of the first personal computer in 1981, followed by the first portable Apple IIc in 1984, the computer—which William O’Neil had touted as a revolutionary technology in the 1960s—was making its way into the mainstream. It was also an era of Wall Street opulence, glorified by the character Gordon Gekko (played by Michael Douglas) and his famous “Greed Is Good” speech from the 1987 movie Wall Street.

At William O’Neil and Company, however, we stayed true to our belief that emotions should be kept out of investing. Using foundational rules, developed over decades of historical stock analysis, our Leaders lists and stock chart services helped our clients navigate the tumultuous 1980s stock market—when many investors experienced some of the highest highs and the lowest lows. In 1984, we added the Leaders and Laggards Large Cap Review (formerly known as the Big Cap Review) to our suite of services.

On February 5, 1982, when most money managers were still bearish, William O’Neil and Company ran a Wall Street Journal ad with the headline “Inflation’s back is broken and it’s time to invest for the recovery ahead.” With a capital gains tax lowered to 20% and inflation declining, our firm believed that common stocks were undervalued. Our market bottom call was accurate and shortly after the WSJ ad ran, a two-decade bull market began—one of the longest and strongest in history.

Expanding our Services

To efficiently provide investors with information not available in The Wall Street Journal and other financial publications, on April 9, 1984, William J. O’Neil launched Investor’s Daily, a 20-page investment newspaper. Investor’s Daily evolved into Investor’s Business Daily (IBD) and expanded its online reach with investors.com as it continues to provide detailed information about stocks, mutual funds, commodities, and other financial instruments aimed at individual investors today.

“The object is to make and take significant gains and not get excited, optimistic, greedy, or emotionally carried away…”

� William J. O’Neil, How to Make Money in Stocks

Black Monday Darkens Wall Street

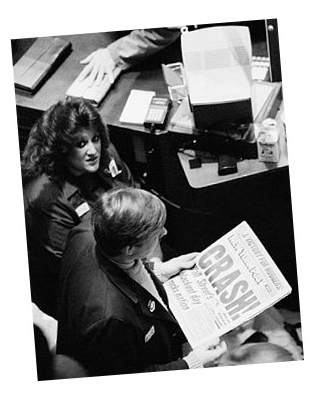

The decade’s bull run was not without its setbacks. In 1987, rumors about interest rate hikes to combat inflation sparked a selloff, and the stock market suffered one of its largest three-day declines in history. The S&P 500 lost 28.5% of its value between Tuesday, October 14 and Monday October 19, 1987, with the majority of the decline occurring on “Black Monday,” when the S&P 500 lost 22.6% of its value—the largest one-day loss in history. But the recession was short-lived, and by the end of the decade those losses had been recouped, making way for a secular bull market that would continue until 2000.

Adding Confirmation to our Methodology

During the 1980s, we continued our extensive model stock studies and added three new volumes of “The Model Book of Greatest Stock Winners” to our growing library of historical stock market research. Toward the end of the decade, William O’Neil published How to Make Money in Stocks, based on these studies. The book, now in its fourth edition, is a national bestseller and has sold over two million copies.